Debt payoff strategies that really work for you

Anúncios

Debt payoff strategies like the snowball and avalanche methods help individuals manage and eliminate debt effectively by prioritizing payments and focusing on either the smallest balances or the highest interest rates.

Are you feeling overwhelmed by debt? Getting a handle on your finances often starts with effective debt payoff strategies. In this article, we’ll explore various methods to help you tackle that debt and regain control.

Anúncios

Understanding different types of debt

Understanding the various types of debt is crucial for managing your finances. Each type of debt has unique characteristics, which can significantly affect how you approach your payoff strategies.

Anúncios

Common Types of Debt

Here are some common types of debt that individuals often encounter:

- Credit card debt – This is typically high-interest debt resulting from using credit cards to make purchases.

- Student loans – Loans taken to pay for education costs, often with lower interest rates and longer repayment periods.

- Mortgages – Loans specifically for purchasing property, generally with lower interest rates and extended terms.

- Personal loans – Unsecured loans that can be used for various purposes, often with fixed payment plans.

Each type of debt can influence your financial strategy. For instance, if you have a large amount of credit card debt, focusing on it first may save you money on interest over time. In contrast, student loans, which may have favorable repayment options or consolidation plans, might be managed differently.

Secured vs. Unsecured Debt

Understanding whether your debts are secured or unsecured is also important. Secured debts are backed by collateral, such as in the case of a mortgage. If defaults occur, the lender can take possession of the collateral. Unsecured debts, like credit cards, do not have this backing, making them riskier for lenders but often burdening borrowers with higher interest rates.

It’s essential to assess and categorize your debts effectively. By knowing your financial landscape, you can better strategize your debt payoff strategies. Take time to review all your debts, understand their implications, and prioritize them based on interest rates and terms. This knowledge is empowering and can lead to significant savings and financial freedom in the long run.

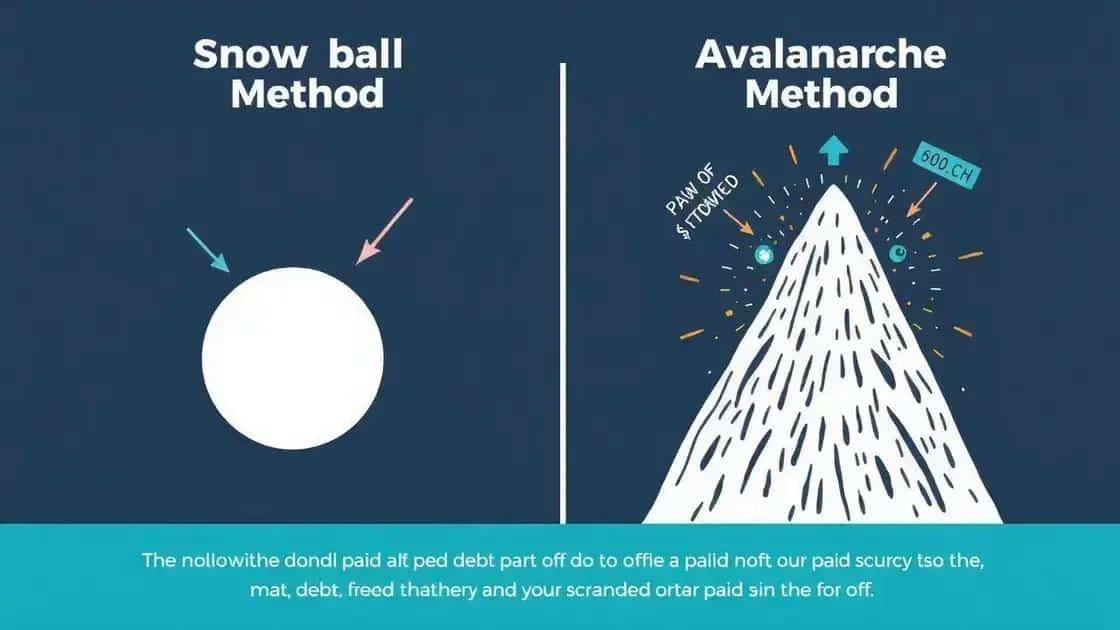

Snowball method vs. avalanche method

When trying to tackle debt, two popular strategies emerge: the snowball method and the avalanche method. Each has its unique approach to helping you pay off debt effectively. Understanding these methods can empower you to make the right choice for your financial situation.

Overview of the Snowball Method

The snowball method focuses on paying off your smallest debts first. By doing this, you get quick wins as you eliminate those smaller amounts. This can provide a psychological boost, motivating you to continue with your debt payoff journey.

- List your debts from smallest to largest.

- Make the minimum payments on all debts except the smallest.

- Put any extra money towards the smallest debt.

- Once the smallest debt is paid off, move to the next one.

As you progress, you build momentum, like a snowball rolling down a hill. Each time you pay off a debt, that amount can be added to your next payment, creating a larger impact.

Overview of the Avalanche Method

The avalanche method, on the other hand, targets the debts with the highest interest rates first. This method can save you more money in interest payments over time, although it might take longer to see the results. It’s a more mathematical approach to debt payoff.

- List your debts from highest to lowest interest rate.

- Make the minimum payments on all debts except the highest interest one.

- Focus extra payments on the debt with the highest interest.

- Move down the list as debts are paid off.

By eliminating high-interest debts first, you can minimize the overall cost of your debt and pay it off more efficiently.

Choosing between the snowball and avalanche method often depends on your personal preferences and financial situation. If you prefer quick wins and need motivation, the snowball method may be the best fit. However, if your goal is to save the most money over time, consider the avalanche method.

Tips for staying motivated while paying off debt

Staying motivated while paying off debt can be a challenge, but it’s crucial for your financial success. Effective strategies can keep your spirits high and your focus sharp as you work towards being debt-free.

Set Clear Goals

Begin by setting specific, measurable, achievable, relevant, and time-bound (SMART) goals. This will give you a clear path to follow.

- Write down your total debt to understand what you are tackling.

- Set a timeline for when you want to be debt-free.

- Break goals into smaller milestones to celebrate small victories.

By having clear objectives, you can track your progress and feel accomplished as you reach each milestone.

Find a Support System

Surrounding yourself with supportive people can significantly boost your motivation. Share your goals with friends or family who can encourage you.

- Join a support group focused on debt management.

- Engage with online communities that share similar financial goals.

- Consider working with a financial advisor for expert guidance.

Having a team to cheer you on during your journey can make a big difference. When you share your progress with others, it creates accountability.

Consider rewarding yourself for reaching milestones. Set aside a small budget for a treat once you pay off a certain amount. This helps keep the journey enjoyable and reminds you to celebrate progress.

Tracking your progress visually can also boost motivation. Create a chart or graph showing your debt reduction over time. Seeing your debt decrease can be very encouraging. Whether you use apps or visual boards, find what helps you keep tabs on your journey.

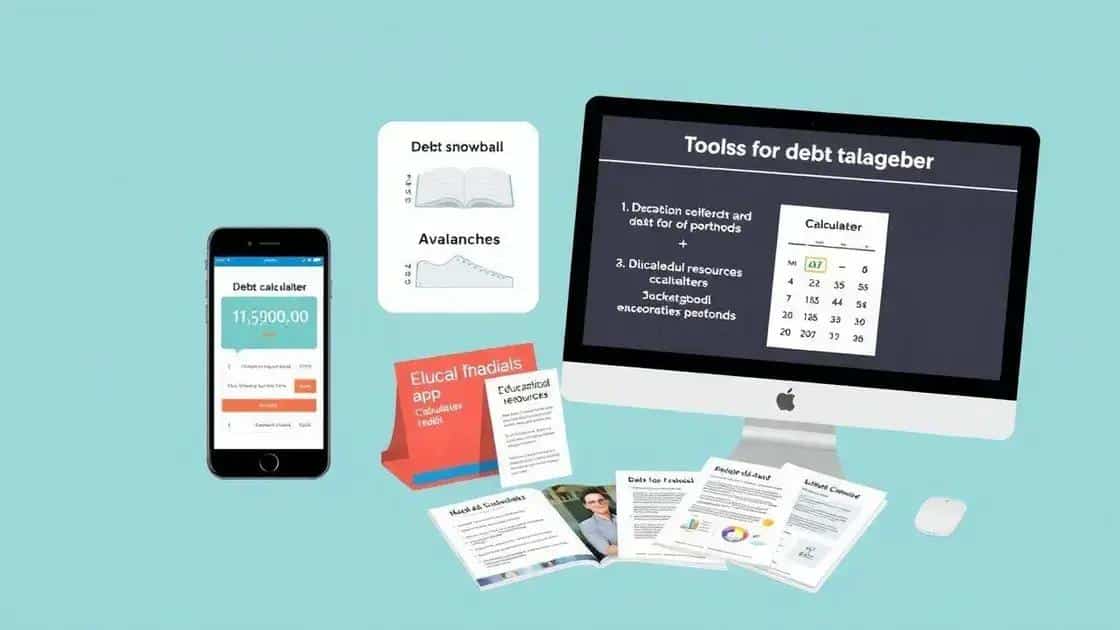

Tools and resources for effective debt management

Managing debt can feel overwhelming, but having the right tools and resources can make a significant difference. Utilizing these can help you stay organized, track your progress, and make informed decisions.

Budgeting Apps

Budgeting apps are essential for keeping your finances in check. They help you monitor your spending and savings in real-time.

- Mint – This app helps track all your accounts in one place and categorize your spending.

- YNAB (You Need A Budget) – YNAB focuses on teaching budgeting principles to help you gain control of your money.

- EveryDollar – This app offers a simple interface for budgeting your expenses each month.

By using budgeting apps, you can clearly see where your money goes each month and identify areas to cut back.

Debt Snowball and Avalanche Calculators

Online calculators can assist you in choosing the best strategy for managing your debt. These tools allow you to simulate different payment strategies.

- Debt Snowball Calculator – This helps visualize how quickly you can pay off your debts by focusing on the smallest balance first.

- Debt Avalanche Calculator – This tool demonstrates how paying off the highest interest debts first can save you money in the long run.

Using these calculators can clarify which method works best for your situation.

Additionally, many websites offer financial education resources. Websites such as NerdWallet and Credit Karma provide articles on debt management, credit scores, and personal finance tips. They can help you make informed choices and give you ideas on managing debt effectively.

Consider also seeking assistance from a financial advisor. These professionals can provide personalized strategies and help you create a tailored debt repayment plan. Whether it’s face-to-face or online consultations, getting professional advice can make a considerable difference in your financial journey.

FAQ – Frequently Asked Questions about Debt Payoff Strategies

What is the snowball method in debt repayment?

The snowball method involves paying off the smallest debts first, giving you quick wins and motivation to continue tackling larger debts.

How does the avalanche method differ from the snowball method?

The avalanche method focuses on paying off debts with the highest interest rates first, which can save you more money in interest payments over time.

What tools can help me manage my debt effectively?

Budgeting apps like Mint and YNAB, along with debt calculators, can help you track expenses and choose the best debt repayment strategy.

Why is it important to set financial goals for debt repayment?

Setting financial goals provides a clear path to follow, keeps you focused, and allows you to celebrate milestones, making it easier to stay motivated.